When Indian students picture a steady, respected career that grows fast, they usually mention the chartered accountancy course. Some claim it is the hardest professional course in India – others say it pays the best. Reality lies between the two extremes.

This guide sets out every key fact about the course in plain language. It tells who may enrol, what topics appear in the syllabus, how the course is built, how many years it needs, what fees arise, which exams appear, what training is required and what jobs follow. Whether you enter after Grade 12 or after a bachelor’s degree, you will find the main questions answered in one place.

Table of Contents

What is a Chartered Accountant?

A chartered accountant is an expert who has completed training in accounting, tax, auditing, finance and business law. Partnerships, new ventures plus government departments all turn to chartered accountants to handle money matters, check that rules are followed and give sound financial advice.

In India the training is run by the Institute of Chartered Accountants of India, the statutory body that writes the syllabus, holds the examinations but also grants the qualification. The course is long and exacting – the letters CA carry weight in India and in many countries abroad.

Overview of the Chartered Accountant Course Structure

Understanding the CA course structure is important before registering. The ICAI has divided the course into three main levels, along with mandatory practical training.

The three levels of the CA course are:

- CA Foundation

- CA Intermediate

- CA Final

Between the Intermediate besides Final levels, students serve a practical training period called articleship. It places them in real offices where they learn the day-to-day work of accounting auditing and taxation. Because of this, every future chartered accountant meets clients, handles documents and sees how rules operate outside the classroom before gaining the final qualification.

CA Course Eligibility Criteria

The door to the CA course opens in two ways – immediately after Class 12 or after finishing a first university degree. The rules differ slightly for each path.

CA Course Eligibility After 12th

A student who has passed the Class 12 examination from a board recognised by the Council may register for the Foundation level of the Chartered Accountancy course.

- Students from any stream can apply

- Registration must be completed with ICAI

- A minimum study period is required before appearing for the exam

This route is popular among students who decide early that they want to pursue chartered accountancy.

CA Course Eligibility After Graduation (Direct Entry)

Graduates can enter the CA course through the direct entry scheme.

Eligibility rules:

- Commerce graduates need at least 55 percent marks

- Non-commerce graduates need at least 60 percent marks

Students entering through direct entry can skip the CA Foundation level and register directly for CA Intermediate. This option saves time and is often chosen by B.Com or finance graduates.

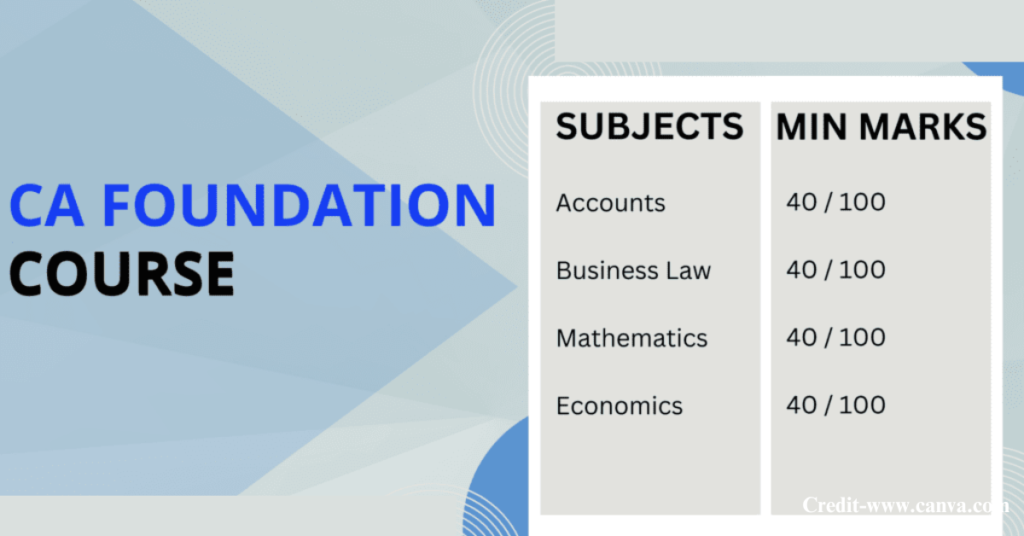

CA Foundation Course Details

The CA Foundation course is the entry-level stage of the chartered accountant course. It builds the base required for higher levels.

CA Foundation Subjects

The CA Foundation course is built around four papers

- Principles and Practices of Accounting

- Business Laws plus Business Correspondence

- Business Mathematics, Logical Reasoning and Statistics

- Business Economics but also Business Knowledge

The first paper shows how to record and report financial events. The second paper explains the main rules that govern business and how to write clear business letters. The third paper teaches the arithmetic, logical thinking as well as data skills needed later. The fourth paper describes how markets work and what every business person should know about commerce, trade or industry.

Exam format

Each paper shuffle multiple choice questions with questions that require written answers. A candidate must score at least forty marks out of one hundred in every paper.

- Minimum 50 percent aggregate to pass

The Foundation level checks whether students are ready for the more demanding Intermediate stage.

CA Intermediate Course Details

After clearing the Foundation exam or entering through direct entry, students move to the CA Intermediate course. This stage is considered one of the most challenging parts of the CA journey.

CA Intermediate Subjects

The CA Intermediate syllabus is divided into two groups.

Group I Subjects

- Advanced Accounting

- Corporate and Other Laws

- Taxation

Group II Subjects

- Cost and Management Accounting

- Auditing and Ethics

- Financial Management and Strategic Management

A candidate sits for either one group or for both groups in the same session. The Intermediate level is passed only after both groups are cleared.

CA Articleship Training Details

Articleship is compulsory practical training plus it forms the core of chartered accountancy education.

What Is CA Articleship?

It is full time training under a practising chartered accountant or a CA firm. Trainees handle live audits, file tax returns, prepare accounts and carry out compliance work.

Duration of Articleship

The training lasts about two years – it begins once the student has passed Intermediate Group I but also has met all ICAI stipulations.

Articleship shows how accounting and tax rules operate outside the classroom – most trainees learn more in those two years than they ever learnt from books.

CA Final Course Details

The CA Final course is the last academic stage of the chartered accountant course. It focuses on advanced concepts and professional application.

CA Final Subjects

The CA Final syllabus is divided into two groups.

Group I

- Financial Reporting

- Advanced Financial Management

- Advanced Auditing and Professional Ethics

Group II

- Direct Tax Laws and International Taxation

- Indirect Tax Laws (including GST)

- Integrated Business Solutions

The Final level tests deep understanding, analytical ability, and practical decision-making skills.

CA Exam Pattern and Passing Criteria

The CA exam pattern remains strict across all levels.

General passing rules:

- Minimum 40 percent marks in each paper

- You need at least 50 percent in every group.

Exams are held about twice a year – good planning, solid revision and practice tests help you pass.

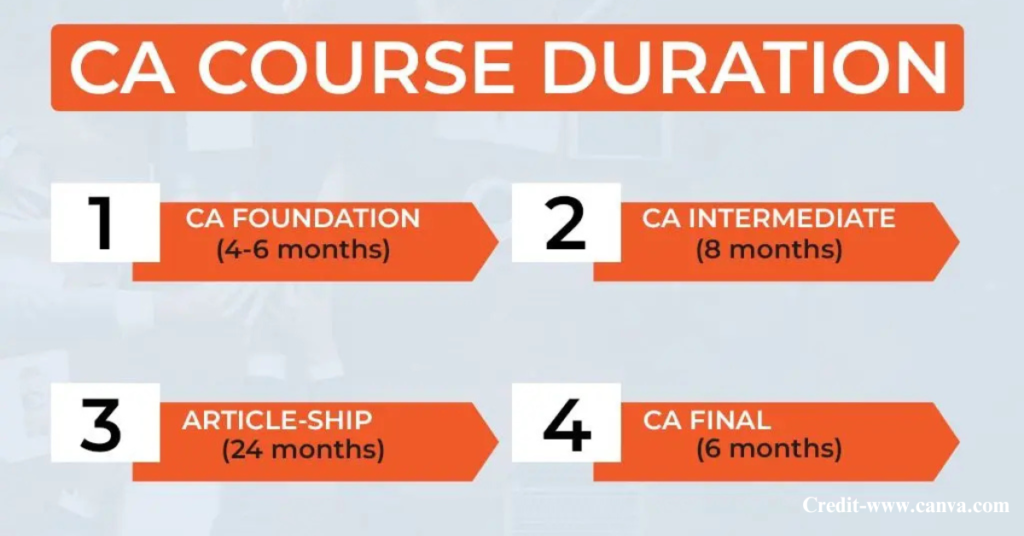

CA Course Duration

Students often ask how long the CA course lasts.

On average

The whole course needs four to five years.

That period covers study time, exams and articleship training.

If you pass every exam on the first try, you finish sooner – if you sit for multiple attempts, you will need extra time.

CA Course Fees and Registration Process

CA Course Fees

The CA course fees include:

- Registration fees

- Exam fees

- Study material costs

ICAI fees are lower than those of many private professional courses, but coaching classes and extra books push the total bill higher.

ICAI Registration Process

To register with ICAI a student normally follows five steps – first, open an account on the ICAI portal. Pick the level you want to enter. Upload the required documents. Pay the registration fee. Wait for the study material to arrive.

Students must visit the official ICAI site to see the current fees and the last date for each stage.

Career Scope After Chartered Accountant Course

The CA career scope is one of the biggest reasons students choose this path.

After qualifying, chartered accountants can work as:

- Auditors

- Tax consultants

- Financial analysts

- Chief Financial Officers

- Business advisors

Many CAs also start their own practice or work with multinational companies. The demand for qualified CAs remains strong across industries.

CA Salary in India

The CA salary in India depends on skills, experience, location, and specialization.

General trends:

- Fresh CAs earn competitive starting packages

- Salaries increase significantly with experience

- Specialization in taxation, audit, or finance leads to higher growth

Chartered accountants who know their subject well usually move into top jobs sooner than most other professionals.

FAQs

How far does the training take?

From the first exam to the final certificate, most people need four to five years. That period includes the required paid work with a practising firm.

Can someone who did not study commerce still train as a CA?

Any student who has finished Class 12 – science, arts or any other stream – may register for the course.

Is the CA course more difficult than other professional programmes?

The work is heavy – yet steady study and a clear timetable bring it within reach.

Is the Indian CA title valued outside the country?

Employers in many nations recognise the Institute of Chartered Accountants of India qualification, above all for posts in accounting and finance.

Final Thought

The chartered accountancy course is not a single certificate – it is a full professional path. It asks for patience, steady discipline and a promise that lasts multiple years. In return it gives solid job security, public respect plus rising income.

Students who like figures, commerce and untangling problems will find that the CA route still belongs to the strongest career options in India. Learning the exact course layout, entry rules, subjects but also job outlook before signing up lets a student choose with clear confidence.

When the steps are mapped out early, the CA years of hard work turn into lifelong professional success.